Be part of the movement!

Welcome to the community for those who value free speech, evidence and civil discourse.Create your free account

36 comments

Feel free to reply to any comment by clicking the "Reply" button.Government needs to quit spending like a drunken sailor and lose the mentality that N America is the welfare state of the world we can’t continue bringing in more dependents

Nailed it! No one wants America to be the world’s policeman, but they sure expect American to be the world’s foster Mom.

The most fair form of taxation is consumption tax, taxes on goods and services at the point of consumption. It ought to be scaled so that necessities are taxed least and luxuries taxed most. That way the poor are not overburdened with taxation and the rich "pay their fair share." Income tax discourages savings and investment, both engines of growth. Tariffs and other excise taxes artificially raise prices on imported goods and disincentivize native business to become competitive with outside corporations. This is not just a national sales tax, it would cover all forms of consumption.

Makes sense.

Yes. A celebrity that owns a 30-million-dollar mansion should be taxed at least 15 million dollars a year. If they own a 5million dollar yacht, tax it five million a year.

@CvBannister I would not go overboard. There are always places that will welcome the wealthy and allow them to build their super estates and have their private jets and yachts.

Cut government by 50%

Good point! But why stop at 50%? The Federal government has grown so bloated that the chief executive cannot control the executive branch, all because Congress has delegated its duties to legislate to the various departments. Make Congress do their job and they won't have time to do politically motivated investigations and bogus, unconstitutional impeachments. Article I of the Constitution of the United States begins thus, "All legislative powers granted herein granted shall be vested in a Congress of the United States, which shall consist of a Senate and a House of Representatives." No where in there does it grant the authority to delegate that power.

ALL taxes are ultimately paid by the consumer, so all of the taxes listed above come out of your’s and my pockets at some, if not multiple points, just fancy names, smoke and mirrors to make us feel good about it. No corporation or business of any kind actually pay taxes, they collect them. Payroll, commodity, services, etc, are added to the overhead column and thereby added to the consumer price tag, the same as excise taxes, then you also pay a sales tax. Estate and gift taxes are paid before hand as income and then after the fact, as income. As a gainfully employed person, I am not particularly adverse to pay some taxes. As a US citizen, I believe it is my duty and honor to pay some taxes. However, I do not approve of how said tax payments are being used or allocated on the whole, lots of waste.

The question basically asks what would be the least painful way to give the govt more money. I'd be more interested in a question that asks which of the hundreds of worthless programs we'd like the govt to abolish.

missing is: issuance of treasury debt followed by monetary policy that encourages mass inflation thereby devaluing the payback of the bond... AKA the suckers tax.

I don't know. Inflation is a flat tax shared by everyone who owns currency. Of course, rich people can afford to shift their assets away from the dollar. But still...

Fair Tax. The idea that anyone else has money except consumers is pure fiction. Government only takes from consumers. Business must pass on every single expense to consumers in their prices, as must corporations. Estate and gift taxes are redundant taxes that the government justifies to collect more goodies to make themselves look good for greater power.

Sales tax is the only fair tax, as the more you spend, the greater the number at exactly the same percentage rate. So it is automatically a progressive tax, without loopholes.

It might drive away those very wealthy individuals who would lose their loopholes and finally have to pay a lot of taxes, but those loyal to the country would stay.

Those who would rip the Constitution to shreds would leave. Good riddance. They never paid any taxes anyway and snubbed their noses at US antitrust laws. They have homes everywhere, and I would be delighted if they took their delusional self-importance elsewhere.

Doesn't really matter does it? I mean whatever the "source" of the money it gets passed along to the consumer in the form of increased costs of living. right? John Q Public foots the bill no matter how you structure in IMHO...but if I am wrong about that let me know please.

Leave it the way it is a society will evolve to the environment. You go messing with it and you have no idea what the consequences will be. That doesn't mean not closing loopholes and other ways people cheat on the system.

We have way to many cheater at every social economic level. Whatever system you adopt people will find a way to cheat.

If you are going to go monkeying around with things I don't see much point to taxing cooperations who can just pass on the tax. If you are someone who instinctively dislikes cooperations them sure you can manipulate the social structure by varying taxes but looking back at most social engineering the unintended consequences exceed the intended consequences. You are talking about something so complicated nobody understands it.

I’m a fan of taxing the shit out of businesses either hiding assets overseas or having manufacturing done overseas and then bringing their products back home to sell.

Want to kill jobs and reduce your tax base? Allow someone to have a sweatshop making their products at 60 cents/hour to be shipped 11,000 miles into a Walmart or wherever rather than having the jobs here, the products made here, and the money remain here.

It think we ought to dump the income tax and go completely to a consumption tax like a sales tax. Income taxes are too hard and too complicated to collect. I even think there should be a consumption tax on stock trades.

Celebrities and the wealthy own toys worth billions. I think we should tax rich people's toys and excessive lifestyle 100% each year Lets hear'em cry for more taxes then.

We need to require the government to live within their means in the way the government expects its citizens to within they means.

Every one of the named taxes ends up in the lap of the guy working his ass off to make ends meet.

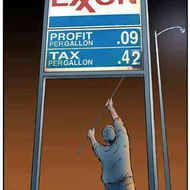

Democrats and liberals scream "Tax the rich, tax the greedy corporations, tax the oil industry!! Yes, Yes we all cheer. And while we're at it increase the duty of imports. It does not take that high on an IQ to realize all those taxes, every last dime, will trickle down to the poor bastard trying to support a family on a dead-end job. The republicans are no less guilty as they spend just as bad. With this government I'm totally fucked. Anybody have an answer? I don't.

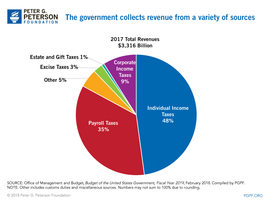

Individual Income and Payroll tax .... are they not basically the same ... for most

That's easy. Tax everybody but me. snowflake alert

I'm with you

I’m guessing that US sales tax is collected at the state level, so it isn’t included here. In Canada it’s collected at the federal and provincial level, and the Goods & Services tax (GST) funds a very substantial chunk of national revenue - close to 12%. The GST plus provincial tax is a pain at the cash register, with Canadians paying around 15% on purchases depending on jurisdiction. But it’s targeted to the biggest spenders, so it’s fair, and lower income people receive quarterly rebate cheques.

I also wonder about US payroll “tax”, which sounds way out of line at 35%. The Canadian chart shows at 6.7% which is the premium deduced from pay cheques for employment insurance.

Income tax in Canada provides over 50% of federal revenues, and the corporate tax rate, is now much higher under our leftist government.

TyKC:

There is no federal US sales taxes, although I believe there should be.

@GeeMac yes, for PA:

"Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood.

The Pennsylvania sales tax rate is 6 percent. By law, a 1 percent local tax is added to purchases made in Allegheny County, and 2 percent local tax is added to purchases made in Philadelphia."

[revenue.pa.gov].

Here in Aotearoa/New Zealand we also have a 15% GST that is levied at every stage from production through retail, so we are effectively paying taxes on taxes (in a devious and stealthy way), and on gasoline over half the cost is tax (currently $1.50/liter for diesel and $2.24/liter unleaded) including blatant GST on underlying taxes. The GST effectively stifles economic activity at all levels and the parasitic government continues to metastasize.

Is fuel was $0.75/liter the pic would definitely be in the ballpark.

Tough one, as I don't think more taxes are the solution to the problem. Maybe the excise tax.

Sort of, but not really.

An excise tax is when you're taxing a specific good for a politic reason; for example, you heavily tax cigarettes because you want to make it more onerous for people to choose to smoke.

A VAT is where you apply a tax to every step of the process where the product is processed or manipulated in some way ("value-added" ); in a practical sense, the more an item is processed, the higher the tax you pay on it. So simple goods, like hand-made stuff, get little VAT, whereas stuff like televisions and automoblies get a high VAT. The goal here is to make it onerous to overconsume or consume non-essential (luxury) goods. That is, if you're wealthy, you'll pay accordingly for your ability to consume.

So they are the same in that they are both consumption taxes, but different in that they serve different purposes.

EDIT: Forgot...a sales tax is simply a flat consumption tax that is applied to all non-essential goods, irrespective of how many processing steps those goods go through.

I'd say that's a fair characterization.

Not having lived in a country that uses VAT, my impression is that it gets really harsh - for example - if you want to own a car, which you could say is a politic agenda to get people to use public transportation and cut down on smog. So politics MIGHT have something to do with VAT, but overall the impression I get is to encourage frugality and simplicity.

Why? Again, just spitballing here, but it could be cultural, and it could be to train people to spend less before they become pensioners and are on the social welfare system.

@Alysandir, @Middleway,

VAT beats GST and both taxes everyone... so it is a way to make sure the tax evaders and cheats at least pay some tax.

GST can hit the poor hard if too high, and VAT is slightly better.

I hate to have many taxes however you need four taxes and they need to adjusted according your economy and social makeup.

Wealth, income, sales and excise.

I also want a “pollution” tax... where every manufacturer or packer pays the total cost of recycling/disposal of packaging and once use only products right in the beginning... and in exchange there are no charges for recycling and waste management later to the public.

@TheMiddleWay Canada implemented a Goods and Services tax (5%) applied across the board on most purchases over 30 years ago. It now provides almost 12% of federal revenue, most of it from affluent spenders. Lower income people who spend less, not only pay less, but are rebated cash quarterly based in overall income. There are broad exemptions for items like fresh foods or educational materials.

Canadians pay a dual federal and provincial sales tax —the total can be as low as 5% or as high as 15% when the provincial portion is added.

Recent Visitors 115

Photos 19 More

Posted by Charter Does a country's wealth come from its energy use?

Posted by Charter Why does the worldwide IQ distribution appear to match racial IQ differences seen in multi-racial countries?

Posted by Charter Why do children raised in same-sex households appear to have worse life outcomes?

Posted by Charter Is it fair that actresses are younger and have shorter careers than actors?

Posted by Charter Why are asylum seekers in EU overwhelmingly (military-aged) men? If asylum seekers were fleeing for persecution reasons, does it make sense that most are young men? Source: [ec.europa.eu]

Posted by Charter Why do young women consider unwanted comments about their appearance as sexual harassment compared to older women?

Posted by Charter Are women aware of the risks of postponing having children?

Posted by Charter Is this proof that income inequality doesn't appear to be cause of white-black SAT/IQ gap?

Posted by Charter Is a multi-cultural society a good thing?

Posted by Charter Why hasn't anti-Muslim sentiment gone down after the spike due to 9/11? Source: FBI Crime Statistics [fbi.gov]

Posted by Charter Why does the average IQ of a country appears to decrease as religiosity increases?

Posted by Charter Northern states tend to have more "social capital". How's yours?

Posted by Charter Most federal revenue comes from income and payroll tax. Is that optimal? Soure: [pgpf.org]

Posted by Charter On a percentage basis, it is much more likely to be killed by a Muslim "terrorist" in the US than a Right-Wing "extremist". Does it feel that way?

Posted by Charter Why do Blacks have a much higher risk of being murdered by other Blacks than they do from Whites? Post suggested by @AdrianRainbow

Posted by Charter What can be implied from the fact that African-American homicide rate mirrors African nations while European-American homicide rate is comparable to European nations? Post suggested by @ZuzecaSape