Be part of the movement!

Welcome to the community for those who value free speech, evidence and civil discourse.Create your free account

36 comments (26 - 36)

Feel free to reply to any comment by clicking the "Reply" button.1st, we should eliminate taxation without representation. If my tax money is going towards the study of a frog's sex life or a bunch of slithery illegal aliens ... then those practices must END immediately. Secondly, I'm for a flat sales tax. Property tax and income tax should be completely eliminated, pronto!

How about taxing toys of the rich. VAT but only for obscene shit like private jets and yachts along with expensive European cars. Mansions that use 10x the energy of a normal home. After all, isn't it the super wealthy celebrities calling for higher taxes.

Politician's incomes should be taxed more.

The U.S. Government is the sovereign issuer of the U.S. Dollar, and it doesn't need to tax its own dollars to have them to spend. Taxation is just a mechanism to create demand for dollars and to regulate the supply of dollars, because taxation has the effect of "unprinting" excess dollars and removing them from the economy to control inflation. It's MMT 101.

I support an appropriate tax strategy, an excellent system which generally ensures contributions are based on income and wealth for the benefit of all. Of course the balance of how much is raised, type and how it is spent is always arguable. What I do think is essential is for demonstration of integrity within the system. At present the super rich and the richer and larger companies have a distinct advantage as employ lawyers and accountants who actively hide and move profit around the world to escape tax. As they are generally also powerful and influential politicians avoid confronting them (Taxing the rich is a subject always neatly avoided at Davos) These should be actively and visibly targeted. It remains obscene that some have extreme wealth whilst others starve. Most of us will willingly contribute if the money is spent wisely for the greater good but require fairness.

I have a hypothesis, that may be completely false, that taxes on the middle class subsidize corporate business. (I am UK based, I don't know about the situation in the US)

The way I think about it, is that low salaries by corporations are only possible because the taxes on the middle class pay for health care, housing and education. This allows large businesses to reduce the minimum salaries they offer to employees, as people can accept those lower salaries, because the middle class, which pays income tax, pay for many of the basics.

At the same time, this reduces the freedom of people on the lower end of salary scales, as they depend on the state to provide for them, and they can't choose for example where to live or where to take their kids to school.

As a middle class tax payer, my preference would be for someone else to pay more tax, rather than me.

It would be interesting to see a mathematical model of different scenarios with different tax assumptions and comparative taxation of different groups of individuals. I imagine this would have been done by some department of government already. FOIA requests anyone?

All business income taxes are ultimately paid by the consumer so it is just an additional income tax on individuals with a lot of government graft and bureaucracy thrown in. Estate taxes tax assets that have already been gained from previously taxed behavior - it is double taxation. And excise taxes can't fund the government needed. So, income taxes are the only viable method of taxation.

I would prefer a universal, non-protective tariff.

Recent Visitors 115

Photos 19 More

Posted by Charter Does a country's wealth come from its energy use?

Posted by Charter Why does the worldwide IQ distribution appear to match racial IQ differences seen in multi-racial countries?

Posted by Charter Why do children raised in same-sex households appear to have worse life outcomes?

Posted by Charter Is it fair that actresses are younger and have shorter careers than actors?

Posted by Charter Why are asylum seekers in EU overwhelmingly (military-aged) men? If asylum seekers were fleeing for persecution reasons, does it make sense that most are young men? Source: [ec.europa.eu]

Posted by Charter Why do young women consider unwanted comments about their appearance as sexual harassment compared to older women?

Posted by Charter Are women aware of the risks of postponing having children?

Posted by Charter Is this proof that income inequality doesn't appear to be cause of white-black SAT/IQ gap?

Posted by Charter Is a multi-cultural society a good thing?

Posted by Charter Why hasn't anti-Muslim sentiment gone down after the spike due to 9/11? Source: FBI Crime Statistics [fbi.gov]

Posted by Charter Why does the average IQ of a country appears to decrease as religiosity increases?

Posted by Charter Northern states tend to have more "social capital". How's yours?

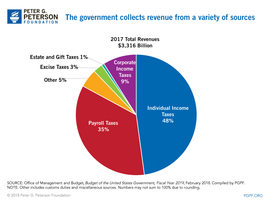

Posted by Charter Most federal revenue comes from income and payroll tax. Is that optimal? Soure: [pgpf.org]

Posted by Charter On a percentage basis, it is much more likely to be killed by a Muslim "terrorist" in the US than a Right-Wing "extremist". Does it feel that way?

Posted by Charter Why do Blacks have a much higher risk of being murdered by other Blacks than they do from Whites? Post suggested by @AdrianRainbow

Posted by Charter What can be implied from the fact that African-American homicide rate mirrors African nations while European-American homicide rate is comparable to European nations? Post suggested by @ZuzecaSape