Bidenflation grows again: Prices spike upward in September-

[hotair.com]

Be part of the movement!

Welcome to the community for those who value free speech, evidence and civil discourse.Create your free account

3 comments

Feel free to reply to any comment by clicking the "Reply" button.A currency based on the value of the economy cannot be flooded into circulation at the rate of the US Dollar in the past three years without losing its value. The value of the economy can only be divided so much and still be meaningful. A currency based on metals is far more stable and cannot be devalued the way the Dollar has been.

Expect them to keep going up until critical mass of people realize that its not that cost going up, its the purchasing power of the dollar going down. When critical mass of people realize this they will seek alternatives and than "money printing" will not be easy way out for the political class.

This is not a Biden issues, that is to say one president or another, republic or democrat. Its a long standing tradition of both parties, that represent one political class.

For example Trump created more debt than Obama by almost twice the amount. And Biden is likely to continue making it twice the Obama + Trump.

When Trump says, we never had economy this good, what he really is saying we never had a bigger credit bubble. When Trump says we never had stock market this good, yeah because that is where all the inflation went to inflate all those fake assets. When Trump says, I'm lowering the taxes, that might be nominally true, but in reality is rose taxes and taxed everyone in the working class by inflation. Inflation is essentially taxation without legislation. When its not politically convenient to tax people, they print and tax by inflation.

Its like when Liz Truss says we will lower the taxes to top class, but we will increase government spending. lol Where does the money comes from, the printing machine. That is why the British pound tanked.

My point is that, people are too fixated on this or that president. There is nothing a single person can do anymore, this is systemic and until it all fails and we are forced to start from scratch, every new politician in office will have to, weather they want to or not, print more.

Its not a partisan issue, its a systemic issue.

When I use word money, I really mean fake fiat currency, but money is often used in colloquial sense. Legally and technically its not money. And they don't really print it anymore, they just mouse click it to existence.

When an American goes to local bank to borrow "money" from the bank, the bank does not have the "money". The simply create it out of thin air, and transfer it to your account. But when you have to pay them back, you have to trade that worthless "money" for goods or services and make a profit so you can return the debt, plus interests. Its a prefect crime for the bankers. There is no real economy.

The purchasing power of the US dollar since the 1900's fell about 98%. It won't take long before they crash it last 2%.

When they printed trillions during scamdamic, they gave it to people to gamble on and people foolishly spend it on fake meme stocks, or crypo etc. Some individuals might have gotten out on time and made some money in this giant ponzi scheme but it was terrible for any pretense of actual economic activity and all the helicopter money they gave away to people with stimulus checks found its way in circulation outside of assets market, causing visible every day inflation. They cannot control that anymore.

Also what Bitcoin was , a place where people were convinced it is where you go to hedge against surging inflation was off course complete nonsense, since Bitcoin is the product on inflation , its where inflation went to hide before it shows its ugly head in the local supermarket.

Nonetheless, people were foolish enough to think Bitcoin is a safe haven, and now that FED is no longer pumping money into crypto it has crashed, and now people are turning to us dollars to fill in the same role. Because of US dollars being reserve currency, and other fake fiat currencies like Euro, British Pound, etc. being just as fake and dependent on the dollar, people have started to use the dollar as they did Bitcoin, a desperate fooling attempt to hedge against inflation in other currencies. Pretty soon dollars will do what bitcoin did, crash. And many will end up holding the bag, once again.

I hope one day people will reject fiat currencies and demand we go and stay on sound money system. Everything else only brings destruction of nations.

Can't speak for anyone else, but I'm still turning profits on my Bitcoin investment. That aside, I get what you're saying, but got to say that I also distrust a sound money system as well. Think in times like this money/currency isn't what's really important to most folks, but rather resources/weapons/adequate consumables supply/medications etc that most people would want to have on hand.

@SpikeTalon Not sure how you are turning a profit on Bitcoin, unless you are selling it before it all goes down, since it is entirely dependent on FED pumping fiat into the system, and that is the problem. Bitcoin is just like Fiat a giant ponzi scheme, but its still a lot smaller ponzi than fiat, so you really can't use it as currency, you can't use it for any practical purpose in a reliable way, you can only gamble on it, that tomorrow you will find someone who is willing to buy it for higher price and you will make a profit. Its like tech stock, and in fact on the stock market bitcoin follows lot of the tech meme stocks in terms of movement up and down. Just make sure you don't end up holding the bag, when it crashes. It has no intrinsic value it entirely depends on gamblers who in turn depend on FED keeping them on life support.

"That aside, I get what you're saying, but got to say that I also distrust a sound money system as well."

I'm not clear why you distrust sound money, but perhaps you can expand on that.

"Think in times like this money/currency isn't what's really important to most folks, but rather resources/weapons/adequate consumables supply/medications etc that most people would want to have on hand."

That's true. However you can't really build wealth or preserve it if you don't relay on sound money. The price of these things such as resources/weapons/adequate consumables supply/medications etc. go up now because of too much fake fiat being created.

US has been living for many years above their means, not because they were smart or hard working, but because of fortunate geopolitical events, such as WWII and other wars and because US has been doing regime changes and bombing anyone who wanted to get off the dollar system that US controls. In effect most of the countries in the world were kept in slavery to US debt so that US and upper classes in the US can live above their means.

But that is in nominal terms. In real terms, US has been bankrupt, had deficits (spending more than they create) since the 1970's. Now just the national debt is nominally over 31 trillion dollars, and US went from being the biggest Creditor nation to being a biggest debtor nation in the world. Americans are living in borrowed time. It US stuck to sound money, this would not be the case.

Furthermore, the only way to preserve wealth is sound money and to some extent other commodities that people need, but in terms of money its previous metals, gold in particular. All else is inadequate as wealth preservation.

You mentioned resources/weapons/adequate consumables supply/medications etc. You have to trade something for that, and unless you take it by force from others, you have to trade for something of actual intrinsic value. US has not being doing that. And eventually, there will be price to pay for that kind of behavior.

Your children if you choose to have any or already have and certainly future generations will have to pay back all the debt created by boomers and other generations living a life of a consumer. Its not possible to ever pay it back in nominal terms, since no one can actually create that kind of money to pay it back, but good times are coming to an end, for many many many generations to come. And weather they like it or not, only way out of it, will be lot of hard work, sweat, blood and tears and sound money system.

You can't have something for nothing, unless you risk everything.

@SpikeTalon

P.S.

You know people claim bitcoin will go to million dollars. I think they might be right, the only problem is that by than eggs will cost two million dollars, so much like in Zimbabwe everyone will be a millionaire and dirt poor.

If it wasn’t for politicians and central bankers finding it impossible to resist either using currency as a tool for economic management or simply as a source of funding government spending, the distinction between money, which evolved into gold through market forces, and currency, always a creature of the state, might not matter.

But the British economist John Maynard Keynes, quoting Lenin said: “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction and does it in a manner which not one man in a million is able to diagnose.”

Germany's 1923 Hyperinflation: A "Private" Affair by Stephen Zarlenga

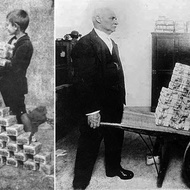

Modern monetary economists define hyperinflation as any inflation rate above 50 percent per year. In the 1920s, Germany had inflation rates in the thousands of percent.

Far too many German marks were being created under the privately controlled Reichsbank. Exactly how, will be discussed shortly. These excessive issues drove down the value of the mark:

By July 1922, the German mark fell to 300 marks for $1; in November it was at 9,000 to $1; by January 1923 it was at 49,000 to $1; by July 1923, it was at 1,100,000 to $1. It reached 2.5 trillion marks to $1 in mid-November 1923, varying from city to city.

These days its just ones and zeros, so "money" can't be even used for toilet paper, starting a fire or wallpapers anymore and when people rush to the ATM's to draw cash way or try to transfer from bank account they will find it closed. Same for crypto.

Than all hell will break loose on the streets and barter and black market will be back in fashion for a while.... until one day, goverment has no choice but to go back to sound money and start over.

As the saying goes: You ain't seen nothing yet!

And sure it will be something we won't forget...

Be part of the movement!

Welcome to the community for those who value free speech, evidence and civil discourse.Create your free account

Share this post

Categories

Slug does not evaluate or guarantee the accuracy of any content. Read full disclaimer.